OCBC

5 Ways Unithree Makes Everyday Financial Advice Click With Gen Z

Share this work

Understanding Gen Z

Gen Z has the lowest financial literacy of all age groups (SNLIK 2024 – OJK & BPS). This makes them more likely to fall into the trap of online loans and impulsive spending, fueled by YOLO and FOMO culture. But here’s the real challenge: Most financial content online feels too formal, full of bank jargon and boring numbers. It doesn’t speak to Gen Z’s world, so they scroll away. That’s where creative marketing and relatable content marketing come in.

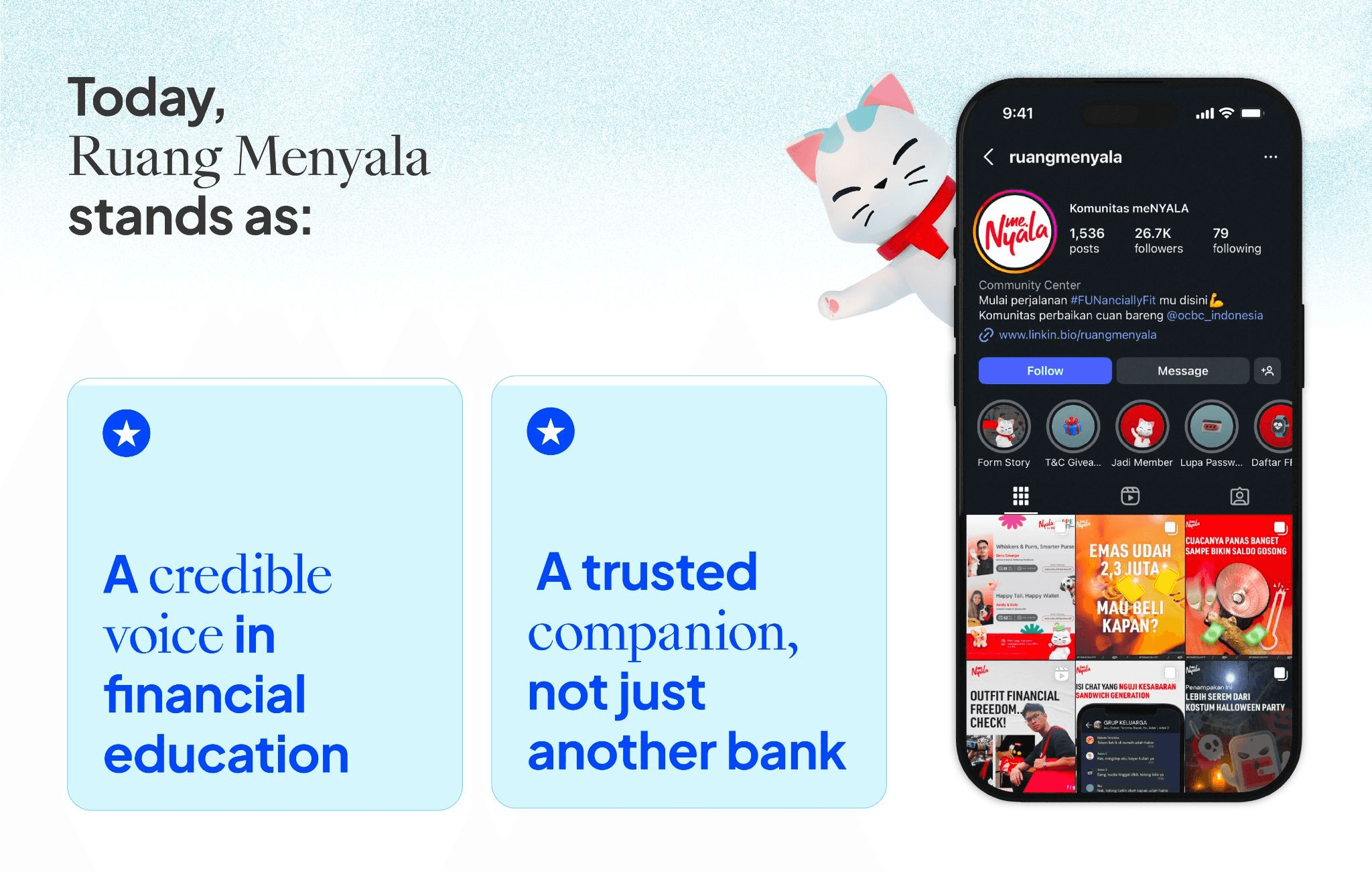

Our Creative Marketing Approach with OCBC’s Ruang Menyala

At Unithree, we teamed up with Ruang Menyala by OCBC to make financial education fun, social, and human. Through OCBC’s #FunanciallyFit campaign, we built a social media strategy that blends real-life stories, humor, and smart money habits, all delivered in a tone Gen Z actually enjoys. Yes, it’s still FOMO-friendly.

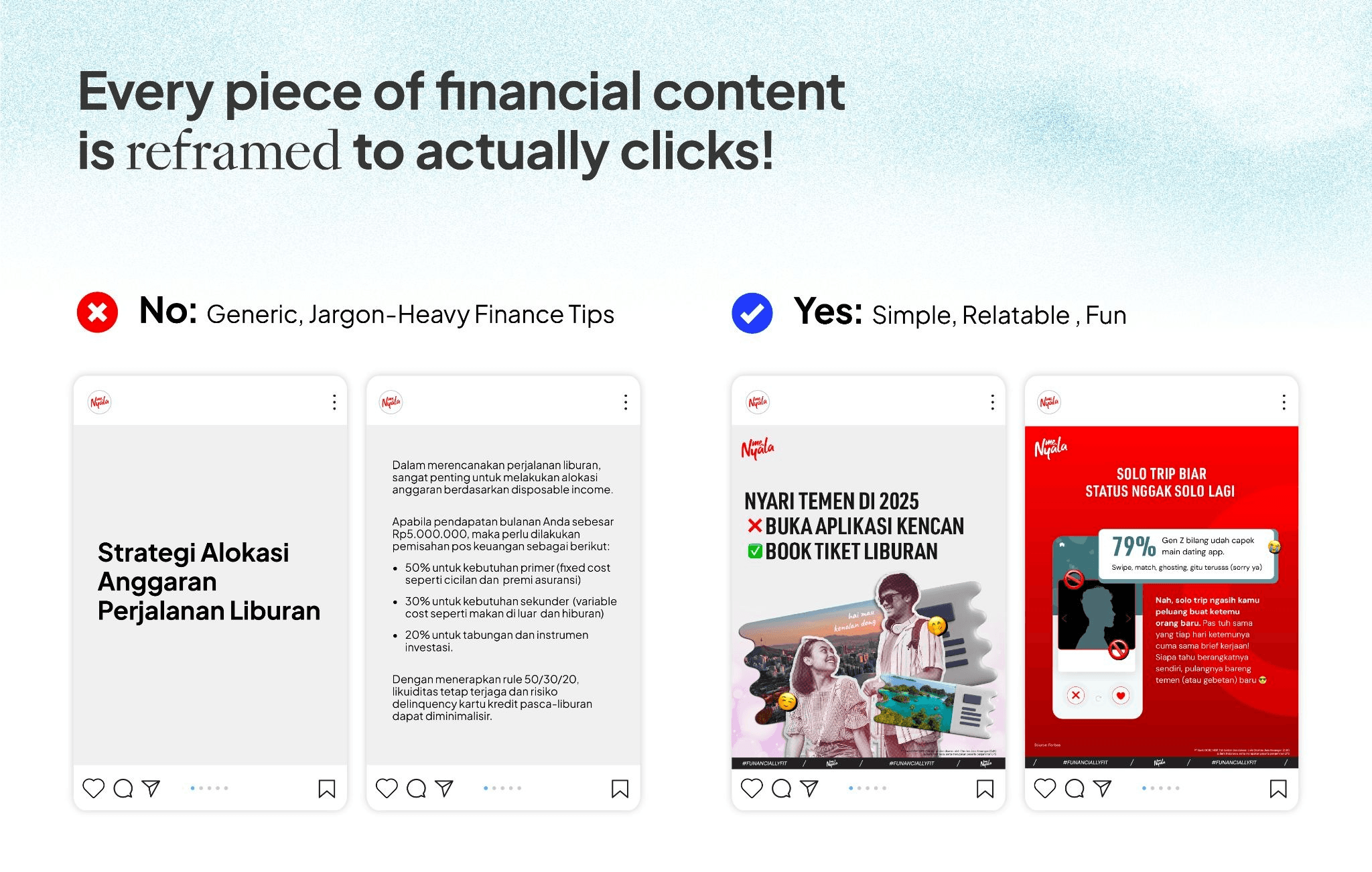

Making Content That Feels Real

We also create dynamic videos and interactive stories that bring #FUNanciallyFit to life across social media. It’s not just another bank post. It's content Gen Z can actually relate to and share.

5 Five Ways Unithree Makes Finance Click With Gen Z

That’s creative marketing that works and still builds trust for the bank. Turning a Bank Into a Trusted Companion.

Share this work

Related Works